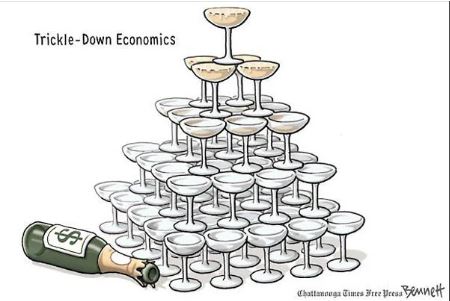

Trickle-down economics refers to a theory that argues economic benefits provided to the wealthy (such as tax cuts, deregulation, and corporate incentives) will eventually “trickle down” to the rest of society, particularly the middle and lower classes. This approach is rooted in the idea that supporting businesses, investors, and the wealthy will stimulate economic growth, create jobs, and lead to increased investments in the economy, which ultimately benefits everyone.

The term is most commonly associated with Reaganomics in the 1980s, although the idea predates it. The notion behind trickle-down policies is that by allowing the wealthiest to accumulate more resources, they will invest in new ventures, infrastructure, and create employment opportunities that uplift the broader population.

Impact on Society

Wealth Disparity: Critics argue that trickle-down economics exacerbates income inequality. While the wealthy may indeed benefit from tax cuts and corporate-friendly policies, the benefits often do not "trickle down" to the poorer segments of society. In many cases, the wealthiest individuals and corporations retain the bulk of their gains, resulting in widening gaps between the rich and the poor.

Job Creation: Proponents suggest that as businesses and the wealthy become more prosperous, they have more capital to reinvest in the economy, leading to job creation. However, studies have shown that this is not always the case, as wealthy individuals may invest in ways that do not directly benefit the job market, such as in financial markets, automation, or overseas ventures.

Investment and Economic Growth: Trickle-down economics assumes that wealthy individuals and corporations will reinvest their surplus capital in ways that stimulate the economy. In practice, much of the capital may not be reinvested in ways that have broad social benefits but instead may be channeled into speculative ventures or hoarded.

Global Impact and Inflation

Global Perspective: In developing countries, trickle-down policies often manifest through global corporations and foreign investments, leading to economic growth in some sectors but not necessarily improving conditions for the poorest populations. For example, in resource-rich developing nations, wealth often accumulates in the hands of a few elites or multinational corporations, while the majority of the population continues to live in poverty.

Inflation: Trickle-down policies can also contribute to inflation, particularly when tax cuts and incentives increase wealth concentration without corresponding increases in production. More money in the hands of the wealthy doesn't necessarily translate to more goods and services being available. When demand remains stagnant and prices increase, inflation can result, disproportionately affecting the poor, who already struggle with rising costs of living.

Role of the Middle Class and Poor

Middle Class: The middle class is often seen as the backbone of a stable economy, but under trickle-down policies, it may bear the burden of tax cuts for the wealthy through reduced public services, such as healthcare, education, and infrastructure. This can weaken the middle class over time, which, in turn, hinders economic growth, as middle-class spending is critical for a healthy economy.

Poor: The poor typically do not benefit directly from trickle-down policies. Without access to wealth, capital, or high-paying jobs, they are more likely to experience stagnant wages, increased cost of living, and reduced social safety nets. While proponents argue that job creation and economic growth will help lift the poor, this is often not borne out in practice. The lower classes often suffer from reduced access to public goods and services due to government budget cuts designed to fund tax breaks for the wealthy.

Trickle-Down Economics and Capitalism

Trickle-down economics aligns with a capitalist framework that favors free-market policies, limited government intervention, and wealth accumulation by individuals and corporations. In theory, capitalism allows for innovation, economic growth, and opportunities for anyone to improve their financial status. However, in practice, this model tends to empower those who already hold significant capital, reinforcing their dominance in the economy.

The idea that capitalism empowers the individual often overlooks the systemic barriers to wealth accumulation for the middle and lower classes. For example, limited access to education, healthcare, or capital can keep large segments of the population from participating in or benefiting from economic growth.

What Comes After Trickle-Down Economics?

After decades of trickle-down policies, many economists and social critics are advocating for alternatives, such as demand-side economics, progressive taxation, or even universal basic income (UBI). These approaches focus on stimulating economic growth by increasing the purchasing power of the middle and lower classes.

Demand-Side Economics: This theory posits that economic growth is driven by consumer demand. By focusing on policies that enhance wages, job creation, and public spending, demand-side economists argue that wealth will circulate more broadly throughout society, benefiting more people than the trickle-down approach.

Progressive Taxation: Taxing the wealthy at higher rates to redistribute wealth is seen as a way to address income inequality. These funds can be used for social welfare programs, infrastructure, and public services that benefit everyone, particularly the most disadvantaged.

Universal Basic Income (UBI): UBI is a policy that provides every citizen with a set amount of money, regardless of their employment status. This helps ensure that the poor and marginalized have enough to meet their basic needs, which can reduce poverty and stimulate economic growth.

Why Not Free Opportunities for Everyone?

The failure of trickle-down economics to create broad-based prosperity highlights the systemic inequality in capitalist systems, where access to wealth and opportunity is often constrained by factors like race, gender, social class, and geography.

Structural Barriers: Issues like racial discrimination, social inequality, and geographical divides make it difficult for everyone to have equal opportunities. Many argue that true equality of opportunity would require systemic reforms in education, healthcare, employment, and social justice.

Global Inequality: On a global scale, factors such as colonialism, exploitation, and unequal trade relationships have kept wealth concentrated in certain parts of the world while leaving others behind. Global capitalism often perpetuates these inequalities, as multinational corporations prioritize profit over fair wages and equitable development.

Empowerment Beyond Wealth: A truly inclusive system would look beyond wealth accumulation as the primary measure of success. It would focus on providing opportunities for meaningful work, fair wages, universal access to education, and healthcare, as well as dismantling the systems of oppression that prevent people from achieving their full potential.

Conclusion

Trickle-down economics is a controversial theory that has shaped economic policies for decades, especially in capitalist countries. While its proponents argue that benefiting the wealthy will ultimately help everyone, in practice, it has often led to greater income inequality, weakened public services, and left many middle and lower-class individuals struggling. Looking beyond trickle-down economics, policies focused on redistributing wealth and creating opportunities for all are increasingly seen as viable alternatives to promote more equitable and sustainable growth.

Welcome to Sazab Moments Section